Summary

Revenue estimates call for 16.2% growth.

Unit sales not likely the key driver.

Apple in line with many "growth" companies.

Unit sales not likely the key driver.

Apple in line with many "growth" companies.

This year's iPhone refresh from Apple (AAPL)

is one that is expected to help the company's revenues surge to a new

all-time high in fiscal 2018. While that may not be surprising to many, a

lot of investors probably don't realize how this growth is likely to be

achieved. Additionally, while the company's top line is expected to

accelerate quite a bit, how many people realize that Apple may rival

many key growth firms over the next year?

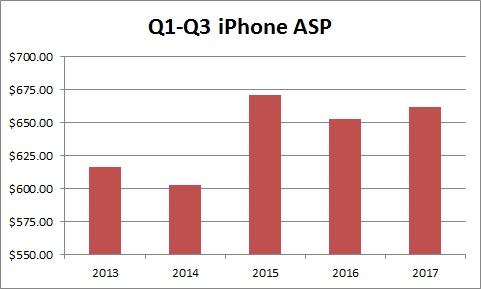

While the

Street is expecting Apple to set a new all-time iPhone sales record for

its September 2018 ending fiscal year at around 245 million units,

that growth is in the low teens percentage wise and not a substantial

surge from the previous record of 231 million seen in fiscal 2015. As an

analyst from Guggenheim points out, a large chunk of the company's

overall revenue growth will be driven by greater average selling prices.

The

iPhone X starting at $999 will obviously be a big reason for the jump

in ASPs, but don't forget that Apple also raised prices from the iPhone 7

to its 8 counterparts. There will be a slight headwind from Apple

selling an extra legacy line, the 6s this time around, as well as a

potential increase in SE sales if the company introduces a second

edition in Spring 2018.

However, the analyst noted

above sees an average iPhone selling price of $770 in fiscal 2018, which

is about $100 above where Apple is now. The chart below shows a

comparison of iPhone ASPs through the first three quarters of its recent

fiscal years, and we've seen a $9 increase this year, although again

still below 2015's high. The last ASP surge came with the huge iPhone 6

cycle.

(Source: Apple quarterly filings)

(Source: Apple quarterly filings)

Every single market news and updates are very important. Commodities like silver and gold are traded on exchange market and to trade them trader should have great experience of the trading because this can also lead to huge loss. Epic Research

ReplyDeleteAs a trader in the stock market, one can buy or sell shares from the secondary market to achieve short term goals. The market goes up or down and so does the share price. Demat account

ReplyDelete